Spain´s services economy: Outlook and challenges

The Spanish services sector will need to undergo significant changes to catch up to other large, advanced EU economies. In addition to private sector investment, the incoming administration should make progress on previously initiated reform efforts to underpin the growth of this sector going forward.

Abstract: Spain is correcting some of the most important imbalances originated before the crisis. One of the clearest examples of this process is the continued downsizing of the construction sector. However, progress is limited on many other fronts regarding the type and sources of growth in Spain. Manufacturing is generating less value added in current prices in 2014 than in 2008, the opposite of what has happened in Germany. The decline of manufacturing decreases the possibilities of advancing in “servitization”, the process by which manufacturing companies begin to provide related services to third parties. The Spanish “pure” service sector must also undergo significant changes if it is to follow the trends of the largest, most advanced EU economies. In particular, increased turnover could be expected mainly in two niches of Spanish business services: ICT consultancy, software and data processing on one hand and private employment services on the other. For this transformation of the services sector to materialise in Spain, private sector investment is a necessary, but probably not a sufficient, condition. Moreover, the new government should aim to make progress on previous reform efforts and finally pass a reform of professional services that effectively liberalises and modernises the sector.

Introduction

The Spanish recovery remains on track in the wake of the crisis. Most headline macroeconomic variables are significantly improving but the functioning of the labour market remains highly problematic. Indeed, the possibility that the way out of the recession takes the form of a “jobless recovery” in advanced economies has been increasingly discussed (see, e.g., Cantore et al., 2013 and Plotnikov, 2014).

Central to those considerations, there is the issue of the growth pattern that Spain and other advanced economies are following. Has the crisis contributed to a positive transformation of these economies, or instead, has growth resumed because they are going back to the “business as usual” model? More specifically, what are the sources of economic growth post-crisis. Is Spain´s growth mostly based on domestic demand or has there been a rebalancing of sources of growth towards external demand? This point is related with the role that services and manufacturing play in advanced economies, as the former tends to be less internationally tradable than the latter.

From this perspective, this article explores the evolution of the services sector in the Spanish economy in the past and its likely outlook for the future. The first section reviews very briefly the most recent literature on the complex interaction between services and manufacturing. We then analyse the past developments in the services sector in Spain from a macroeconomic viewpoint. The findings are contrasted with two other large EU economies, which are more or less comparable to Spain: Germany and Italy. The former is considered to be at the efficiency frontier in both services and manufacturing, while the latter might qualify as a better, direct benchmark, for the Spanish case. Subsequently, the analysis is extended to business services (also known as “professional services”), which are generally considered to have high growth potential, as they are inputs for the outsourcing and offshoring processes. Finally, we include some considerations regarding the future development of the professional services sector in Spain, taking into account the shortcomings of the various attempts at regulatory reform thus far. Conclusions are presented in the final section.

Manufacturing and services: Two sides of the same coin?

There is an increasing body of evidence that suggests that the traditional divide between manufacturing and services is likely to be overestimated by the available statistical classifications of activities and by empirical and theoretical work. In line with Crozet and Milet (2015a and 2015b), some of the stylized facts that emerge from the analysis of this literature are the following:

- Manufacturing companies use services in their production process. Whether these services are in-house or acquired in the market, global offshoring and outsourcing trends tend to strengthen this link over time.

- However, an increasing number of companies also produce and sell services to third parties, known as “servitization.” These services offered by manufacturing firms are generally complements to the (final or intermediate) goods originally produced by the company.

- Making the “servitization leap” is neither costless nor easy for companies as this usually requires adapting the whole organization to a new business model. However, “servitization” is rewarded in general terms with better performance. Based on a sample of French firms, Crozet and Milet (2015a) find that firms that start selling services experience an increase in their profitability between 3.7% and 5.3% and increase their employment by 30%.

Servitization provides one possible avenue for overcoming the risk of a “jobless recovery” mentioned above. For this to be the case, public policies that aim to foster sustainable, balanced growth should adopt specific industrial policies that exploit all of the growth potential related to “servitization.”

The exhibits represent the evolution of five broad branches of services (see the Note for Exhibit 1 for further details):

(i) wholesale and retail trade, transport, accommodation and food service activities,

(ii) information and communication activities,

(iii) financial and insurance activities,

(iv) real estate activities; and,

(v) professional, scientific and technical activities.

To allow for benchmarking, the value added of another three industries is represented: the total value added for the whole economy, the manufacturing sector and construction activities.

In the case of Spain, the overall level of activity in 2014 is still below the level in 2008. As is well known, the industry that is still suffering most of the adjustment in the country is the construction sector, whose value added is less than half of that in 2008 (in current prices). The manufacturing sector as well as financial and insurance activities, is also showing a downward trend. In the case of manufacturing, this dates back from earlier than 2008 (in 2014 it was generating 85% of the value added it did in 2008). Against this background, most of the services sectors have remained near the same levels between 2008 and 2014, with the exception of real estate activities, whose value added had grown almost 30% (presumably related to the increase in the volume of second-hand house trading and renting).

The trends in Italy, albeit milder, essentially mimic what has happened in Spain but the experience in both southern countries is quite different from that in Germany. In aggregate terms, while the total value added in Spain represented 92% of that in 2008, in Italy it was 98% and in Germany it reached 114%. While Italy´s construction and manufacturing sectors have suffered (with a weaker intensity than in Spain), Germany has experienced important growth rates in both industries: 15% in manufacturing and 32% in construction.

Specifically, regarding services, and therefore perhaps setting a benchmark for Spain once it definitely recovers from the crisis, in Germany, the fastest growing sector is information and communication (ICT) activities (growth of 17% between 2008 and 2014) followed by the financial and insurance business (growth of 13%). This sector is also the only one which, apart from real estate, has grown in Italy (6%). Both sectors, ICT and financial intermediation, have had a negative trajectory in Spain since 2008.

Assuming that, in the steady state, Spain will gradually converge to these two, large advanced EU economies, it is therefore expected that these two activities will increase their share in the Spanish economy.

The case of business services

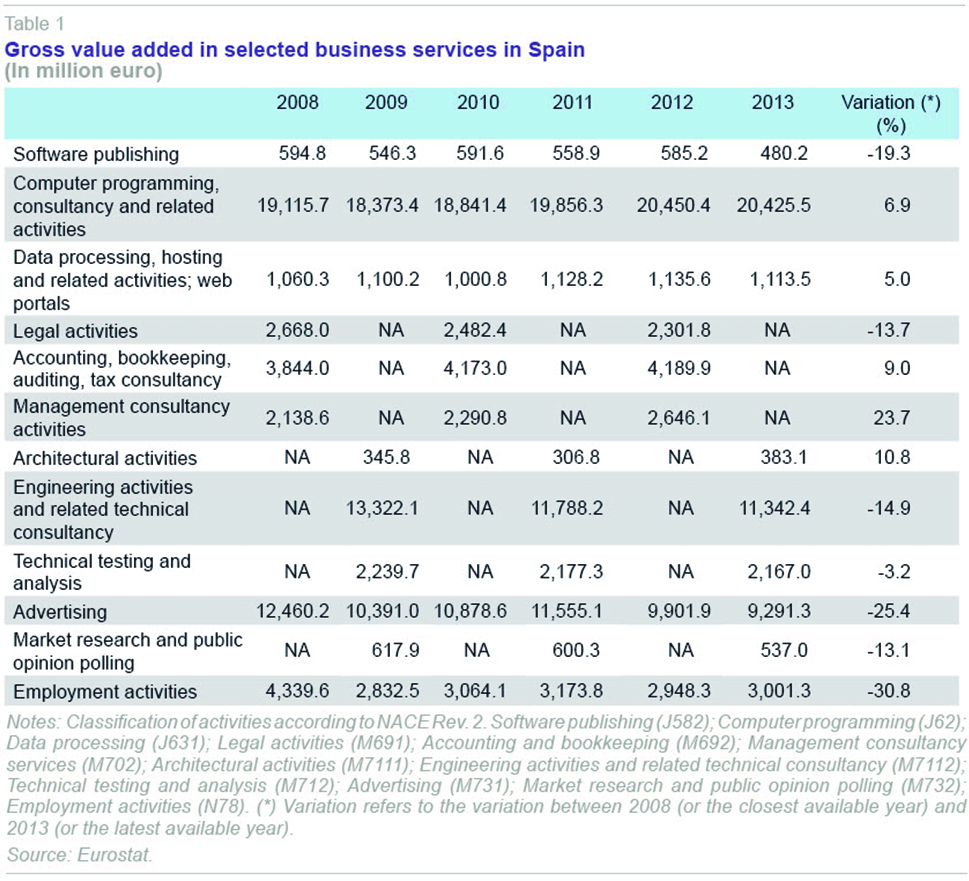

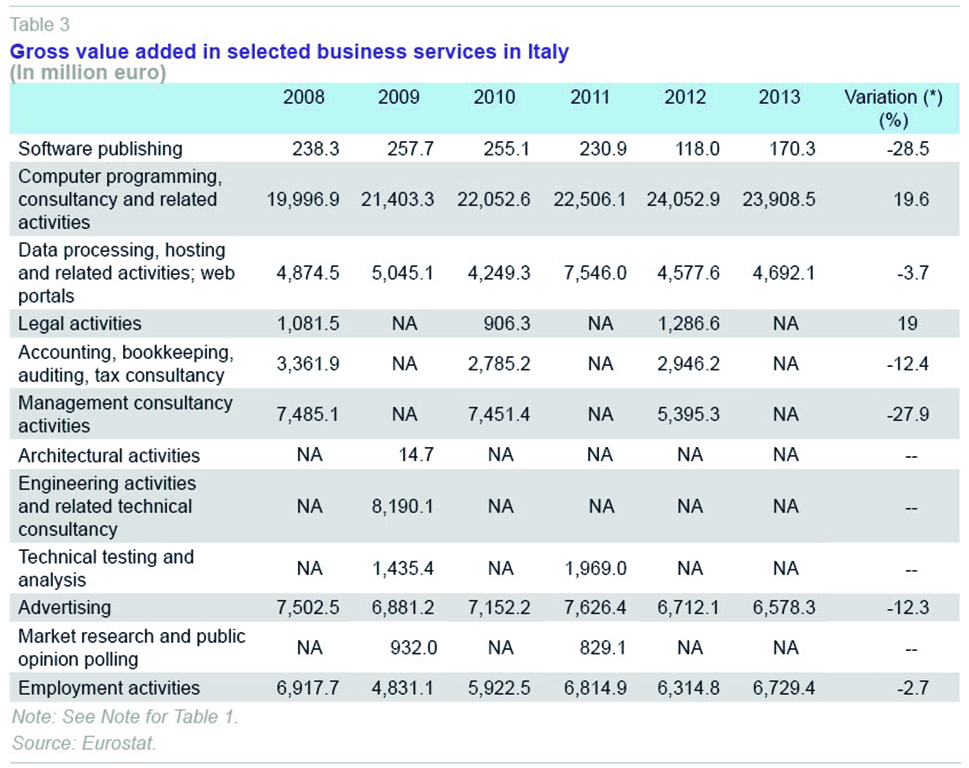

Table 1, Table 2 and Table 3 represent the gross turnover, in million euro, for twelve business services activities in Spain, Germany and Italy, respectively. Business services, such as consulting, engineering, legal or financial advice, marketing experts, various ICT tasks and functions within the company, etc. are generally considered to be key drivers of knowledge-based firms and economies. These services are provided by highly qualified professionals and, in some countries, there are certain restrictions to the access and exercise of these activities based on educational requirements or membership in certain bodies or professional associations. For this reason, these services broadly correspond to those activities known as “professional services.” Eurostat provides detailed data for these services but the time coverage is not complete nor homogenous across countries.

In the case of Spain, turnover has decreased in seven of the twelve business services and increased in the other five sectors. The average variation across the twelve business services is a decrease of 5.4%, with the larger falls taking place in employment services (private agencies that provide part-time or temporary work for client companies), advertising and software publishing. On the other extreme of the spectrum, the largest increase in turnover corresponds to management consulting activities, which is likely to reflect the impact of outsourcing of the strategic management function within Spain. The case of Italy offers a similarly dismal perspective (an average reduction of 6% across the twelve sectors).

The evolution in both countries, however, contrasts very strongly with the case of Germany, where the average turnover of business services has increased by more than 80% between 2008 and 2014. In this country, the turnover of services related to software creation, data processing and computer programming and consultancy has multiplied by factors of 6.6, 2.4 and 1.4 respectively. The other broad sector of business services with the largest turnover growth is employment activities. Recall that this was precisely the business service that had the largest decrease in Spain over the same period.

This basic analysis suggests that within the specific sector of business activities, provided that Spain conforms to the growth pattern observed in Germany, there is scope for growth in the data and software related services as well as in the employment services offered to private companies.

The regulatory landscape for professional services in Spain: Past experiences and outlook

The transposition of the European Commission Services Directive (2006/123/EC) in Spain represented an important step forward in the liberalisation of the sector in Spain (see Ciarreta et al., 2014 for a more complete account of the process and for a survey of pending issues).

However, even after the transposition of the directive, the professional services sector in Spain remains subject to excessive control and regulation, which adversely affects prices, output and quality of service. As a result, there have been multiple calls from international institutions to reform the professional services regulations in Spain (see, for instance, IMF 2014, 2015 and European Commission 2014, 2015).

These recommendations in general agree on the direction of the change: the number of professions that require compulsory registration requirements should be reduced and the transparency and accountability of professional bodies should improve with the overarching goal to open up unjustifiably reserved activities in the access to and the exercise of professional services in Spain. According to the Spanish Government, this sector of activity concentrates 30% of graduate employment in Spain.

On the policy front, the Spanish Government released a draft reform of professional services on August 2013, but since then, there has been no progress and therefore, the regulation of professional services remains unchanged. The Spanish competition authority (CNMC) issued an assessment of the draft reform and produced anexhaustive and comprehensive analysis of the situation (CNMC, 2013) that can be considered a sensible roadmap for the reform. Nevertheless, pressures and lobbying effort from various interest groups potentially affected by the new regulations (engineers of various fields –in some case with conflicts between fields–, architects, lawyers, pharmacists, etc.) have complicated the outlook for the reform´s timely approval (see Xifré 2015 for an updated overview).

In any event, the last two Spanish administrations have failed to pass the reform that each of them has prepared. This situation has led to concerns at the European Commission level, indicating that “the government is running out of time to reform professional services” (European Commission, 2015).

Unfortunately, it remains an open question whether the new government will be able to pass a reform that has been drafted so many times only to be finally postponed. At the time this article was written, it was not yet clear what the next government will be in Spain, as December general elections were inconclusive. In any event, it cannot be assumed that the new government will have the political will to overcome special interests groups – which, so far, have been remarkably active in their opposition to the project – and to pass a reform that liberalises the sector.

Conclusions

Spain continues correcting the imbalances of the crisis, as evidenced through the reduction of the construction sector, whose 2014 contribution to the economy was less than half its value added in 2008.

However, progress on securing other types and sources of growth remains limited. In particular, Spain is not following the trajectory of leading, large EU economies, such as Germany, which has increased the value added generated by manufacturing by 15% between 2008 and 2014. In the case of Spain, the evolution of this sector has been exactly the opposite and the value added generated by the industry in 2014 is 15% less than that in 2008.

This is important not only for the manufacturing sector itself but because of the growing “servitization” trends within that industry. Some of the most successful companies that begin to provide services to client firms come from the manufacturing sector. These services tend to be of high value added and complement the (final or intermediate) goods that company was originally producing. In this respect, the decline of Spain´s manufacturing sector is doubly concerning, as it depresses the possibilities of advancing in the “servitization” process.

As regards “pure” services, the structure of the sector in Spain must still undergo substantial changes if it is to follow the trends in Germany. Assuming this were to happen in Spain, growth would be expected in two areas: ICT consulting, software and data processing and private employment services. In Germany, the combined turnover of the business services related with data processing, software and ICT consulting has more than doubled between 2008 and 2014, while in Spain it has barely grown 5%. Second, over the same period, private employment services, i.e. the services that private companies offer to fill vacancies in third companies, especially with part-time and temporary contracts, has grown by almost 70% in Germany, while it has decreased by 30% in Spain.

These changes obviously require private sector investment, but public policy support to provide an enabling environment is also needed. In particular, although in the recent past, there was some progress on draft regulation, the past two governments have not yet succeeded in reforming the restrictive regulations surrounding the professional services sector. It is time for the new, incoming government to follow international advice, as well as domestic recommendations, and to effectively liberalise and modernise this vital sector for the Spanish economy.

References

CANTORE, C.; LEVINE, P., and G. MELINA (2013), “A Fiscal Stimulus and Jobless Recovery,” IMF Working Paper, Research Department, 13/17.

CIARRETA, A.; ESPINOSA, M. P., and A. ZURIMENDI (2014), “Reform of Spain’s professional services market: Implementation of the EU Services Directive,” SEFO – Spanish Economic and Financial Outlook, Vol. 3, No. 4.

CNMC (2013), Informe de Proyecto Normativo 110/13 relativo al Anteproyecto de Ley de Servicios y Colegios Profesionales, November 2103.

CROZET, M., and E. MILET (2015a), “Should everybody be in services? The effect of servitiaztion on manufacturing firm performance,” CEPII Working Paper, 2015-19.

— (2015b), “The future of manufacturing lies in services,” Voxeu.org Column, 14 December 2015.

EUROPEAN COMMISSION (2014), Post-Programme Surveillance Report - Spain. Autumn 2014 Report, European Economy, Occasional Papers, 206, December.

— (2015), Post-Programme Surveillance Report - Spain. Spring 2015 Report, European Economy, Occasional Papers, 211, May.

IMF (2014), Article IV Consultation Spain 2014, IMF Country Report, No. 14/192.

— (2015), Article IV Consultation Spain 2015, IMF Country Report, No. 15/232.

PLOTNIKOV, D. (2014), “Hysteresis in Unemployment and Jobless Recoveries,” IMF Working Paper, Institute for Capacity Development, 14/77.

XIFRÉ, R. (2015), “Recent reforms in Spain’s business climate: Assessment and pending issues,” SEFO – Spanish Economic and Financial Outlook, Vol. 4, No. 2.

Ramon Xifré. Associate Professor of Economics and International Business, ESCI-UPF and Policy Research Fellow, Public-Private Sector Research Center at IESE Business School